Can We Find New Ways to Pay?

May 4, 2023

• At the first night of the Annual Town Meeting on Monday, May 1, 2023 the Finance Committee warned members of the likely increase in property taxes due to large projects in upcoming years.

Needham has taken on several major capital projects in recent years and with more on the horizon, many are wondering if the town is biting off more than it can chew. At the Annual Town Meeting on May 1st, Finance Committee Chair John Connelly presented an update on the town’s current debt position and what that means for taxpayers.

Needham has two major debt policies to ensure the town’s financial stability. The first policy states the town will allocate 3% of the projected tax levy for its yearly debt service. The second policy stipulates the total debt service, including debt exclusion, which is allowed to be raised outside of the tax levy limit in that given year, cannot exceed 10% of the town’s gross revenue.

According to Connelly, “The 3% and the 10% policies allow us to address our capital needs without mortgaging away our future. Debt is a non-negotiable obligation that must be repaid according to the agreed upon terms. The risk of exceeding these debt policies is that in hard times debt repayment cannot be reduced. Instead, salary, staffing and services may suffer.”

Currently, Needham has $31.5 million in debt authorized by Town Meeting. The future projects contained in the town’s five year Capital Improvement Plan require the town to borrow approximately $41 million within its tax levy. Additionally, two projects on the horizon that will require debt exclusions are the $60 million DPW complex reconstruction and the $330 million school buildings project.

According to the analysis provided to Town Meeting by the Finance Committee, if the town goes ahead with all its planned capital projects, it will exceed the 3% debt policy for nine years starting in 2026 and exceed the 10% debt policy for 12 years starting in 2028.

Connelly warned that this would be unprecedented. “The town has never exceeded its debt policy limits for such lengths of time and in such amounts ever before.”

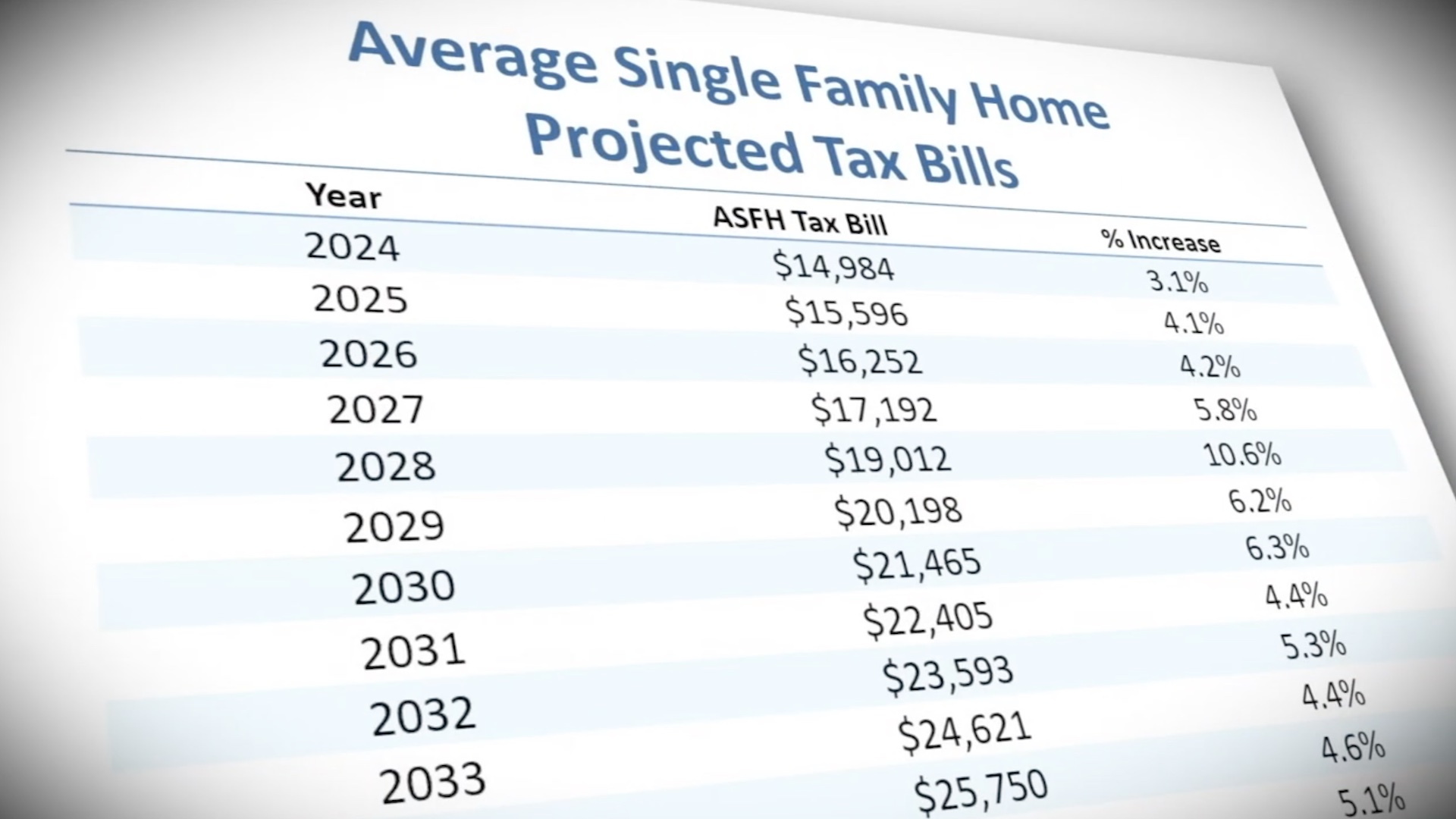

As a result, the Finance Committee projects that property taxes will increase significantly. In fiscal year 2023, the average single family home paid $14,528 in taxes. But by 2029, that number would be expected to climb to over $20,000 and closer to $30,000 by 2037.

Although Needham is fraught with challenges, it also holds the promise of potential new revenue streams. Take for instance, the future life science development on the former Muzi site, which could generate substantial income for the town. For the town officials, it’s a delicate balancing act.

Said Connelly, “We look forward to working with the many stakeholders to arrive at a plan that addresses the town’s capital needs in a prudent, measured and affordable way, keeping in mind the ages and the economic means of all of our town residents. As we continue the planning process, the Finance Committee will also take into account other potential sources of revenue for funding capital projects, such as the Debt Service Stabilization Fund, as well as partnering as we have in the past with the Massachusetts School Building Authority to provide funding for our schools projects.”